How is Sedona Tourism and Hospitality industry growing?

According to the City Financial Reports Sedona Tourism is growing.

2021 Bed Tax Revenue jumped 72%.

2022 it jumped another 25%. This year appears to be running at 26% higher than FY 22.

All lodging types including vacation rentals inside the city limits are imposed city-bed-taxes.

Those outside city limits do not pay city-bed-tax while they all use the name “Sedona”

All lodging inside the city limits including vacation rentals pay bed tax at 3.5%, a combined sales tax & bed Tax 7%.

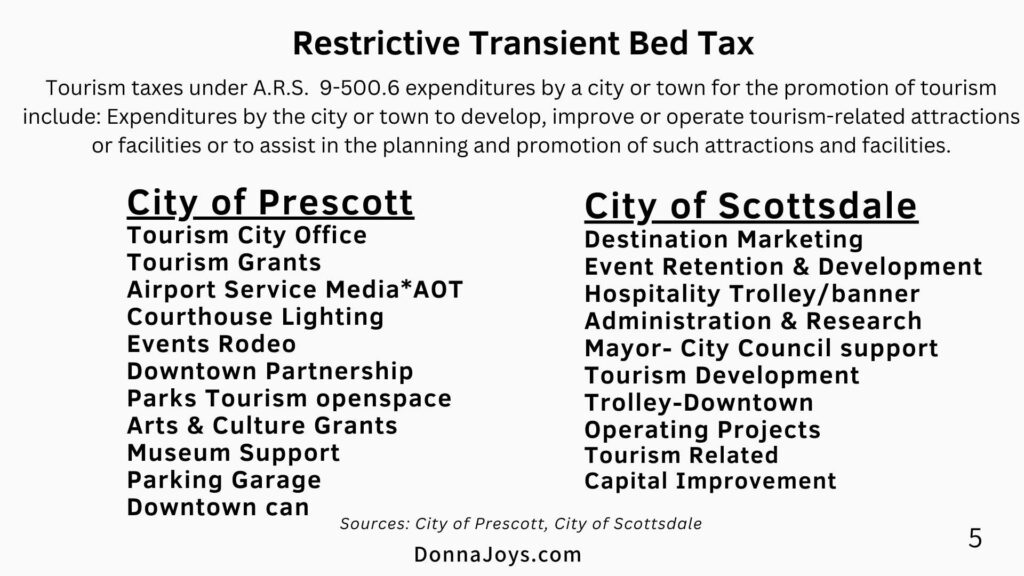

Why is the .5% bed tax important and how can it be used?

In 2014 when the city bed tax was raised .5% that action triggered that portion (.5%) to be used, reinvesting in tourism. The original city bed tax of 3% remains the same with no restrictions.

The City of Sedona already uses up the restricted .5% on programs, services, management, and planning provided directly by the city.

Only .5% is restricted under A.R.S. § 9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds; exemption; definitions https://www.azleg.gov/ars/9/00500-06.htm

How much is the .5% ?

The total amount of city bed tax revenue is 3.5% then the .5% is 14.29% of actual bed tax revenues. The 3% equals 85.71%. Combining the two totals equals 100%.

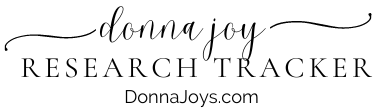

Restrictive Usage of City Bed Taxes

In Prescott, Flagstaff and Scottsdale the Voters control the rate and restricted the amount by voting on it.

These cities as they are in the benchmark. Tourism Government Models DMO Benchmark

In Sedona, it is the City Council that votes on city tax rates. When the city raised the bed tax higher than the sales tax that triggered the .5% raise following A.R.S. § 9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds; exemption; definitions.

Sources: City of Scottsdale, City of Prescott 2022 budget

D. For the purposes of subsection C, expenditures by a city or town for the promotion of tourism include:

The law explains “3. Expenditures by the city or town to develop, improve or operate tourism related attractions or facilities or to assist in the planning and promotion of such attractions and facilities.”

The City of Sedona already supports Tourism with many services.

This would include the Parks Tourism open space, Sedona Shuttle, Uptown restrooms, parking agreements, Tourism Related Capital Improvements, grants to the arts, Events, Traffic Control, and management are a few that come to mind. But the list is long.

Here is some items the city already does and could do with the .5%

Sedona City Ordinance NO. 2013-07 the city council “under the recommendations of the Sedona Chamber & Sedona Lodging Council” Sedona City Council voted to increase the bed tax rate .5%, but agreed to use 55% of the total city bed tax in the promotion of tourism. “City of Sedona to devote an increased level of revenues to the promotion of tourism and destination marketing in order to attract greater numbers of visitors and tourists and thereby generate increase sales and bed tax revenues”

This is 50% more than required by law. The decision to do so was under the Sedona Chamber a private membership and the Sedona Lodging Council an affinity group from the chamber.

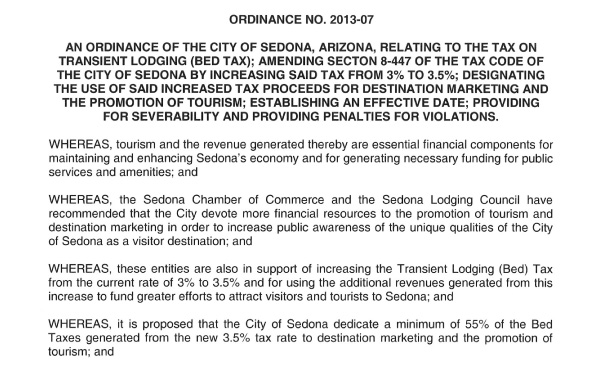

Sedona Chamber’s Affinity Groups 2013-2014

The decision to raise City Bed Tax and denote 55% to Tourism was based off “under the recommendations of the Sedona Chamber & Sedona Lodging Council” The Sedona Lodging Council is an affinity group of the chamber.

At the same time, the City of Sedona entered into a No Bid contract with the Sedona Chamber, a private membership corporation.

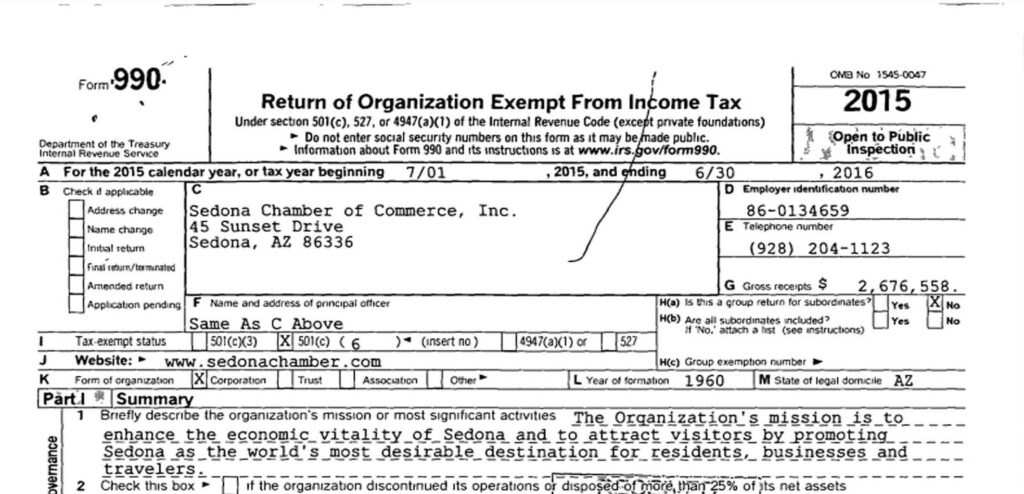

According to the Sedona Chamber Tax returns they incorporated in 1960 as a business association of members.

Arizona corporation records show the Sedona Chamber incorporated as Oak Creek Chamber of Commerce.

The City of Scottsdale, the City of Flagstaff, and the City of Prescott have “Restricted Bed Tax” and none of them outsource 100% of the City Tourism Program and management to a private membership. In fact, I can’t find one in the entire State of Arizona that does. All those in the benchmark clearly manage and control the city policy. Tourism Government Models DMO Benchmark

Wow, doesn’t this make your head spin?

There is more………

Did you know that the Chamber has received $18,529,327 since 2014?

The Chamber has used these city tax dollars for

Chamber members, branding and keeping all websites, programs and collateral as the Sedona Chambers.

Chambers tax returns 2020 revenues

88.51% City Taxes imposed on in-city

10.88% Membership Dues

0.6 % Event revenues

Wouldn’t now be a perfect time to review, and determine what fits the City of Sedona best? Shouldn’t a City Tourism program be at the City level instead of at the hands of a regional chamber? Let the City decide, and end the no-bid contract. Simplify it.

Sedona doesn’t have a Tourism Authority District and doesn’t qualify to be one under A.R.S. § 5-802 Formation of authority AZ Sports & Tourism Authority Program & Tracker

Is there a simple cost-effective and efficient solution?

Let’s understand more by gathering the data as other cities do with City Tourism & Stats Reporting, connecting that with the Sedona City Finance Records. Then let’s account for all the city services the city already provides for Tourism and review where we are at.

Please use your voice please let the Sedona City Council and City Manager know we need change. In small cities like Sedona your voice can make change.

Write City Hall –

sjablow@sedonaaz.gov

hploog@sedonaaz.gov

mdunn@sedonaz.gov

bfultz@sedonaaz.gov

pfurman@sedonaaz.gov

kkinsella@sedonaaz.gov

jwilliamson@sedonaaz.gov

KOsburn@sedonaaz.gov

Have a question? Call me 928-282-4635 Email donna@DonnaJoys.com

The Sedona City Council has a joint meeting with the Sedona Chamber on January 11, 2023

The Chamber will present to City Council their ideas.

Link to Chambers 103 page presentation

Special City Council Meeting

Wednesday, January 11, 2023, 1:00 p.m.

Courtyard by Marriott-Sedona Meeting Room

4105 West State Route 89A

Please note this City Council meeting is offsite at the Courtyard by Marriott

City Council Retreat is also coming up on January 17&18, 2023.

The Sedona City Council will discuss set goals, and priorities, and direct City Manager for the next fiscal year. The Sedona City Council will decide then.

Now is the time to be heard!

Let’s put residents, small businesses, and small-town charm on the Sedona City Menu. We will only be on the menu when we speak up.

Donna Joy’s Research Projects

Fact Check the Fact Checker