A.R.S. § 5-802 Formation of Authority

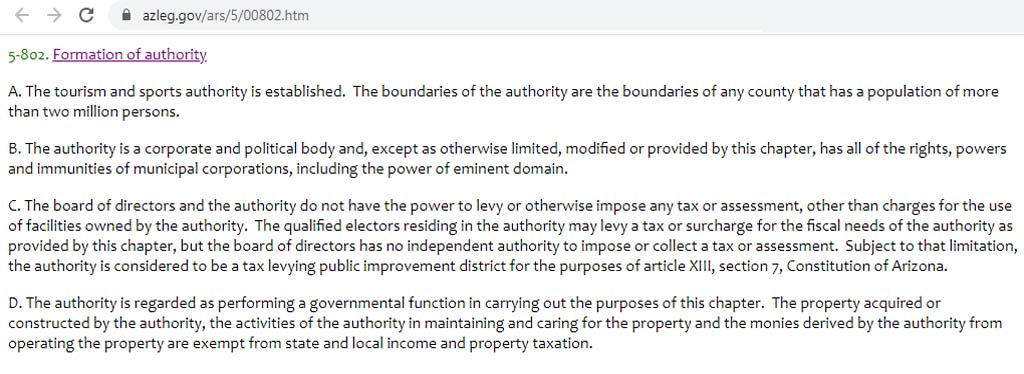

5-802. Formation of authority

A. The tourism and sports authority is established. The boundaries of the authority are the boundaries of any county that has a population of more than two million persons.

B. The authority is a corporate and political body and, except as otherwise limited, modified or provided by this chapter, has all of the rights, powers and immunities of municipal corporations, including the power of eminent domain.

C. The board of directors and the authority do not have the power to levy or otherwise impose any tax or assessment, other than charges for the use of facilities owned by the authority. The qualified electors residing in the authority may levy a tax or surcharge for the fiscal needs of the authority as provided by this chapter, but the board of directors has no independent authority to impose or collect a tax or assessment. Subject to that limitation, the authority is considered to be a tax levying public improvement district for the purposes of article XIII, section 7, Constitution of Arizona.

D. The authority is regarded as performing a governmental function in carrying out the purposes of this chapter. The property acquired or constructed by the authority, the activities of the authority in maintaining and caring for the property and the monies derived by the authority from operating the property are exempt from state and local income and property taxation.

Sources: State of Arizona, Arizona Sports and Tourism Authority, Arizona Office of Tourism,

Donna Joy’s Research Tracker contains hyperlinks to sources is located at the base.

Donna Joy can be reached at donna@donnajoys.com (928) 282-4635

Maricopa County Sports Authority Proposition 302

Maricopa County has an Authority

Maricopa County has Proposition 302 that created an Authority, in 1999 Maricopa voters approved the Proposition 302 initiative, which includes funding to promote tourism in Maricopa County. The AZ Sports Authority Prop 302 is a governmental function.

Bylaws ASTA Bylaws AZSTA

AZSTA Board of Directors

AZSTA Board of Directors

The AZSTA Board of Directors is comprised of nine citizens of Maricopa County who volunteer their time and accept no compensation or per diem.

The Board members are appointed to five-year terms by the Governor (5), the President of the Senate (2) and the Speaker of the House (2) and are eligible to serve two terms.

Board appointees are appointed to achieve a balanced representation of the Valley’s regions as well as the Tourism Industry, Cactus League, Valley Hotel Industry and Youth Sports

Title 41 – State Government

§ 41-2306 Tourism fund

The office of tourism shall administer the account.

Title 41 – State Government § 41-2306 Tourism fund

A. The tourism fund is established consisting of separate accounts derived from:

1. State general fund monies appropriated to the fund by the legislature. All monies in this account are continuously appropriated to the office of tourism for the purposes of operations and statewide tourism promotion.

2. Revenues deposited pursuant to section 5-835, subsection B or C. All monies in this account are continuously appropriated to the office of tourism, which, in consultation with a consortium of destination marketing organizations in the county in which the tourism and sports authority is established, shall be spent to promote tourism within that county. For fiscal years 2010-2011 and 2011-2012, fifty per cent of the revenues deposited in the tourism fund pursuant to this paragraph may be expended by the office of tourism for operational and administrative purposes.

3. Revenues deposited pursuant to section 42-6108.01. The legislature shall appropriate all monies in this account to the office of tourism, which, in conjunction with the destination marketing organization in the county in which the tax revenues are collected, shall be spent only to promote tourism within that county and shall not be spent for administrative or overhead expenses.

4. Revenues deposited pursuant to section 5-601.02(H)(3)(b)(iv). The office of tourism shall administer the account. The account is not subject to appropriation, and expenditures from the fund are not subject to outside approval notwithstanding any statutory provision to the contrary. Monies received pursuant to section 5-601.02 shall be deposited directly with this account. On notice from the office of tourism, the state treasurer may invest and divest monies in the account as provided by section 35-313, and monies earned from investment shall be credited to the account. No monies in the account shall revert to or be deposited in any other fund, including the state general fund. Monies in this account shall supplement, not supplant, current funds in other accounts of the tourism fund. Monies in this account shall be spent only to promote tourism within the state and shall not be used for administrative or overhead expenses.

B. Monies in the fund are exempt from the provisions of section 35-190 relating to lapsing of appropriations.

Donna Joy’s Research Projects

Fact Check the Fact Checker