There has been so much misinformation on Sedona City Bed Tax being generated from the Sedona Chamber.

- 9-500.06 This law is for governing TAXATION in the hospitality industry at the local level, a municipality.

- This law is only one law of many for Cities and Towns. It is not the States Tourism Policy. This law doesn’t define the State of Arizona “legal entity for a DMO” The law isn’t the State of Arizona Tourism Policy nor does it go into the Tourism-Program-Policy details nor define the Tourism words or terms.

April 12, 2023, Sedona City Council Meeting, the City Attorney, Kurt Christianson, explained that based upon ARS 9-500.06 law, it is a City Tax, not a pass-through tax. The Council has all rights to keep it in place. Video link at 1:45 https://sedonaaz.new.swagit.com/videos/223918

Please watch it. The city of Sedona has NO legal requirement to market Sedona.

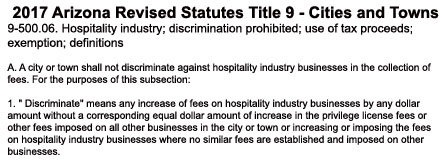

Understand the law A.R.S. 9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds;

9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds; exemption; definitions A.R.S. § 9-500.06

A. A city or town shall not discriminate against hospitality industry businesses in the collection of fees. For the purposes of this subsection:

1. “Discriminate” means any increase of fees on hospitality industry businesses by any dollar amount without a corresponding equal dollar amount of increase in the privilege license fees or other fees imposed on all other businesses in the city or town or increasing or imposing the fees on hospitality industry businesses where no similar fees are established and imposed on other businesses.

2. “Fees on hospitality industry businesses” means annual liquor license taxes or fees or annual renewal or reissuance fees for municipal business privilege licenses, however denominated.

B. A city or town shall not increase the fees on hospitality businesses in any year by an amount that exceeds the amount of any increase in the consumer price index compared to the average of the last five years of consumer price indexes.

C. On or after the effective date of this amendment to this section, if a city or town, by passing an ordinance or charter amendment by its governing council or by a public vote, establishes a discriminatory transaction privilege tax or increases its existing discriminatory transaction privilege tax on hospitality industry businesses greater than any increase imposed on other types of businesses in the city or town, the proceeds of the established discriminatory transaction privilege tax, except as provided in subsection D, and the proceeds of any increase above the existing discriminatory transaction privilege tax shall be used exclusively by the city or town for the promotion of tourism. For the purposes of this section a tax which is in effect on April 1, 1990 and is subsequently renewed by a majority of qualified electors voting at an election to approve the renewal is not considered a tax increase.

D. For the purposes of subsection C, expenditures by a city or town for the promotion of tourism include:

1. Direct expenditures by the city or town to promote tourism, including but not limited to sporting events or cultural exhibits.

2. Contracts between the city or town and nonprofit organizations or associations for the promotion of tourism by the nonprofit organization or association.

3. Expenditures by the city or town to develop, improve or operate tourism related attractions or facilities or to assist in the planning and promotion of such attractions and facilities.

E. If a city or town has not imposed a discriminatory transaction privilege tax up to a two per cent tax level on hospitality industry businesses as of April 1, 1990 and thereafter imposes or increases such a discriminatory transaction privilege tax, the first two percentage rate portion of the discriminatory transaction privilege tax is not subject to the provisions of subsection C.

F. The collection by a city or town of a fee or tax prohibited by this section shall be void and unlawful. For a five year period following the unlawful collection of the fee, the city or town shall reimburse the hospitality business for any reasonable expense incurred in collecting from the city or town any fees or tax unlawfully collected.

G. For the purposes of this section:

1. “Discriminatory transaction privilege tax” means any transaction privilege tax rate imposed by a city or town on hospitality industry businesses that is above the transaction privilege tax rate imposed by a city or town equally on all businesses subject to a transaction privilege tax.

2. “Hospitality industry businesses” means:

(a) A restaurant, bar, hotel, motel, liquor store, grocery store, convenience store or recreational vehicle park.

(b) A motor vehicle rental agency in a county stadium district which has imposed the car rental surcharge pursuant to section 48-4234.

The Resident’s Footprint is how we create clear, open-door discussions, accept each other’s differences, collaborate working together, utilize each different strengths, nurture, and improve.

Unlimited each other to grow, learn and build our community.

Did we welcome the community as a whole to the table?

Or were the only ones at the table the loudest, controlling the narrative and outcome?

Did we restrict another person by restricting where and how they spoke? Did we label another and not listen to their ideas or suggestions?

The Resident’s Footprint is our community legacy, how we leave our community.

How we nurtured, supported, understood, collaborated, respected others, and set aside any conflicts of interest is our footprint. Going through opens doors taking chances that may help to grow our legacy and our footprint.

~ yours, ours, and my Sedona ~

Changes and improvements we make through collaboration and networking leave a balanced footprint for generations to come.

DonnaJoys.com

9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds; exemption; definitions A.R.S. § 9-500.06

Learn more about Sedona Community Issues and join in community conversations

Facebook Groups:

Sedona Politics in Motion

Greater Sedona ~ Quality of Life

Sedona Open Bulletin Board

Donna Joy’s Research Projects

Fact Check the Fact Checker